With all eyes set on her, Nooyi should focus her efforts at getting more fruitful acquisitions

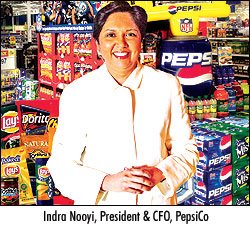

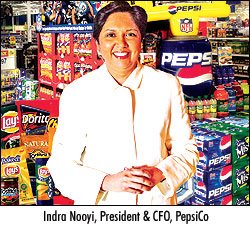

So what if Indra Nooyi earned derision from the Americans after her (in)famous ‘Long Middle Finger’ speech at the Columbia Business School? She could still boast about the unstinted support she has received from the top brass at PepsiCo. No wonder she is now the new CEO at Pepsi. That’s quite a journey for the lady from Madras Christian College who is now set to become arguably the most powerful woman CEO in the world. After all, she will lead a company that tops the list (in revenues) among 11 Fortune 500 companies led by women CEOs. And yet, the accolades also conceal challenges

what if Indra Nooyi earned derision from the Americans after her (in)famous ‘Long Middle Finger’ speech at the Columbia Business School? She could still boast about the unstinted support she has received from the top brass at PepsiCo. No wonder she is now the new CEO at Pepsi. That’s quite a journey for the lady from Madras Christian College who is now set to become arguably the most powerful woman CEO in the world. After all, she will lead a company that tops the list (in revenues) among 11 Fortune 500 companies led by women CEOs. And yet, the accolades also conceal challenges  that Nooyi faces. The most significant would be matching the track record set by her predecessor Steve Reinumund, who led the $32.6 billion conglomerate since the year 2001. Reinumund has masterminded a net earnings growth of 70% and an 80% rise in Earnings Per Share (EPS) since 2001, not to forget an m-cap crossing the magic mark of $100 billion. His enduring legacy will be the fact that Pepsi’s market capitalisation raced ahead of Coke’s once when he was leading the Pepsi troops. Can Nooyi better that?

that Nooyi faces. The most significant would be matching the track record set by her predecessor Steve Reinumund, who led the $32.6 billion conglomerate since the year 2001. Reinumund has masterminded a net earnings growth of 70% and an 80% rise in Earnings Per Share (EPS) since 2001, not to forget an m-cap crossing the magic mark of $100 billion. His enduring legacy will be the fact that Pepsi’s market capitalisation raced ahead of Coke’s once when he was leading the Pepsi troops. Can Nooyi better that?

Having served at global giants like Boston Consulting Group, Johnson & Johnson, Asea Brown Boveri Inc. and Motorola Inc., Nooyi, no doubt, has the pedigree to improve upon Reinumund’s legacy. Reinmund asserted, “Indra’s record of transforming PepsiCo speaks for itself, she’s been an invaluable partner and ally throughout my time as CEO. I am convinced she’s more than qualified and clearly ready for her new role.”

But what about the critics who doubt that her success story will run smoothly for long? Well, she has certainly silenced critics in the past. A typical instance was in 2001, when she successfully reduced the asking price for Quaker Oats. Wall Street applauded the manner in which the then CFO of Pepsi saved ‘billions’ on the $14 billion deal. The icing on the cake was the health drink Gatorade that has helped Pepsi dominate the rapidly growing sports drinks market. Nooyi has engineered over a dozen acquisitions in 12 years at PepsiCo including the $3.3 billion takeover of Tropicana. Nooyi also worked on the restructuring that created YUM, the umbrella brand now controlling KFC, Taco Bell & Pizza Hut.

But what about the critics who doubt that her success story will run smoothly for long? Well, she has certainly silenced critics in the past. A typical instance was in 2001, when she successfully reduced the asking price for Quaker Oats. Wall Street applauded the manner in which the then CFO of Pepsi saved ‘billions’ on the $14 billion deal. The icing on the cake was the health drink Gatorade that has helped Pepsi dominate the rapidly growing sports drinks market. Nooyi has engineered over a dozen acquisitions in 12 years at PepsiCo including the $3.3 billion takeover of Tropicana. Nooyi also worked on the restructuring that created YUM, the umbrella brand now controlling KFC, Taco Bell & Pizza Hut.

The task that lies ahead of Nooyi is to ensure that Pepsico’s principal businesses (Frito-Lay, Pepsi-Cola, Gatorade, Tropicana & Quaker foods) perform to potential with a special attention on PepsiCo’s market share of carbonated soft drinks, which has fallen by 0.3% in 2005 to 31.4% (a Beverage Digest survey). She must also spearhead more and more acquisitions for Pepsi to remain ahead. Also, expansion of businesses in African and Asian markets (with revenue growth of 14% & 11% respectively) are the key. And speaking of Asia, Nooyi faces an immediate dilemma with the pesticides controversy in India, resolving which would need more than mere financial wizardry.

The task that lies ahead of Nooyi is to ensure that Pepsico’s principal businesses (Frito-Lay, Pepsi-Cola, Gatorade, Tropicana & Quaker foods) perform to potential with a special attention on PepsiCo’s market share of carbonated soft drinks, which has fallen by 0.3% in 2005 to 31.4% (a Beverage Digest survey). She must also spearhead more and more acquisitions for Pepsi to remain ahead. Also, expansion of businesses in African and Asian markets (with revenue growth of 14% & 11% respectively) are the key. And speaking of Asia, Nooyi faces an immediate dilemma with the pesticides controversy in India, resolving which would need more than mere financial wizardry.

Nooyi’s ascent to the upper echelons of power in America Inc. has been through sheer hard work and determination. Although the challenges are enormous, the fact that Nooyi has seen Pepsi through some of its toughest years (as colas have declined in popularity ratings) makes her the right person for the job. Only, pointing fingers is bad manners, a lesson she must not forget.

So

what if Indra Nooyi earned derision from the Americans after her (in)famous ‘Long Middle Finger’ speech at the Columbia Business School? She could still boast about the unstinted support she has received from the top brass at PepsiCo. No wonder she is now the new CEO at Pepsi. That’s quite a journey for the lady from Madras Christian College who is now set to become arguably the most powerful woman CEO in the world. After all, she will lead a company that tops the list (in revenues) among 11 Fortune 500 companies led by women CEOs. And yet, the accolades also conceal challenges

what if Indra Nooyi earned derision from the Americans after her (in)famous ‘Long Middle Finger’ speech at the Columbia Business School? She could still boast about the unstinted support she has received from the top brass at PepsiCo. No wonder she is now the new CEO at Pepsi. That’s quite a journey for the lady from Madras Christian College who is now set to become arguably the most powerful woman CEO in the world. After all, she will lead a company that tops the list (in revenues) among 11 Fortune 500 companies led by women CEOs. And yet, the accolades also conceal challenges  that Nooyi faces. The most significant would be matching the track record set by her predecessor Steve Reinumund, who led the $32.6 billion conglomerate since the year 2001. Reinumund has masterminded a net earnings growth of 70% and an 80% rise in Earnings Per Share (EPS) since 2001, not to forget an m-cap crossing the magic mark of $100 billion. His enduring legacy will be the fact that Pepsi’s market capitalisation raced ahead of Coke’s once when he was leading the Pepsi troops. Can Nooyi better that?

that Nooyi faces. The most significant would be matching the track record set by her predecessor Steve Reinumund, who led the $32.6 billion conglomerate since the year 2001. Reinumund has masterminded a net earnings growth of 70% and an 80% rise in Earnings Per Share (EPS) since 2001, not to forget an m-cap crossing the magic mark of $100 billion. His enduring legacy will be the fact that Pepsi’s market capitalisation raced ahead of Coke’s once when he was leading the Pepsi troops. Can Nooyi better that?Having served at global giants like Boston Consulting Group, Johnson & Johnson, Asea Brown Boveri Inc. and Motorola Inc., Nooyi, no doubt, has the pedigree to improve upon Reinumund’s legacy. Reinmund asserted, “Indra’s record of transforming PepsiCo speaks for itself, she’s been an invaluable partner and ally throughout my time as CEO. I am convinced she’s more than qualified and clearly ready for her new role.”

But what about the critics who doubt that her success story will run smoothly for long? Well, she has certainly silenced critics in the past. A typical instance was in 2001, when she successfully reduced the asking price for Quaker Oats. Wall Street applauded the manner in which the then CFO of Pepsi saved ‘billions’ on the $14 billion deal. The icing on the cake was the health drink Gatorade that has helped Pepsi dominate the rapidly growing sports drinks market. Nooyi has engineered over a dozen acquisitions in 12 years at PepsiCo including the $3.3 billion takeover of Tropicana. Nooyi also worked on the restructuring that created YUM, the umbrella brand now controlling KFC, Taco Bell & Pizza Hut.

But what about the critics who doubt that her success story will run smoothly for long? Well, she has certainly silenced critics in the past. A typical instance was in 2001, when she successfully reduced the asking price for Quaker Oats. Wall Street applauded the manner in which the then CFO of Pepsi saved ‘billions’ on the $14 billion deal. The icing on the cake was the health drink Gatorade that has helped Pepsi dominate the rapidly growing sports drinks market. Nooyi has engineered over a dozen acquisitions in 12 years at PepsiCo including the $3.3 billion takeover of Tropicana. Nooyi also worked on the restructuring that created YUM, the umbrella brand now controlling KFC, Taco Bell & Pizza Hut. The task that lies ahead of Nooyi is to ensure that Pepsico’s principal businesses (Frito-Lay, Pepsi-Cola, Gatorade, Tropicana & Quaker foods) perform to potential with a special attention on PepsiCo’s market share of carbonated soft drinks, which has fallen by 0.3% in 2005 to 31.4% (a Beverage Digest survey). She must also spearhead more and more acquisitions for Pepsi to remain ahead. Also, expansion of businesses in African and Asian markets (with revenue growth of 14% & 11% respectively) are the key. And speaking of Asia, Nooyi faces an immediate dilemma with the pesticides controversy in India, resolving which would need more than mere financial wizardry.

The task that lies ahead of Nooyi is to ensure that Pepsico’s principal businesses (Frito-Lay, Pepsi-Cola, Gatorade, Tropicana & Quaker foods) perform to potential with a special attention on PepsiCo’s market share of carbonated soft drinks, which has fallen by 0.3% in 2005 to 31.4% (a Beverage Digest survey). She must also spearhead more and more acquisitions for Pepsi to remain ahead. Also, expansion of businesses in African and Asian markets (with revenue growth of 14% & 11% respectively) are the key. And speaking of Asia, Nooyi faces an immediate dilemma with the pesticides controversy in India, resolving which would need more than mere financial wizardry.Nooyi’s ascent to the upper echelons of power in America Inc. has been through sheer hard work and determination. Although the challenges are enormous, the fact that Nooyi has seen Pepsi through some of its toughest years (as colas have declined in popularity ratings) makes her the right person for the job. Only, pointing fingers is bad manners, a lesson she must not forget.

No comments:

Post a Comment